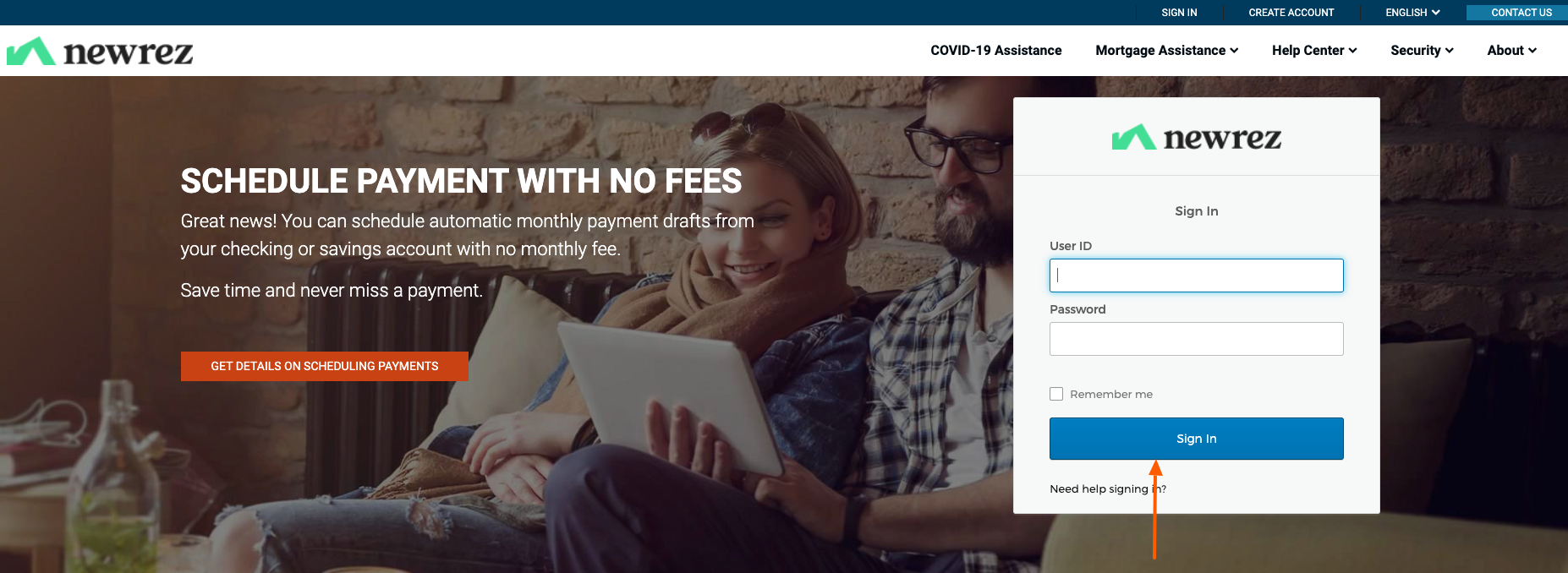

newrez myloancare MyLoanCare Online Account – newrez.myloancare.com

NewRez MyLoanCare Login: New Penn Financial also known as NewRez LLC, founded in 2008. This is a nationwide mortgage lender with licenses in all 50 states and Washington, D.C. They offer a multitude of flexible home loan solutions to make homeownership a reality for its customers. You can get traditional loan products such as conventional and government-backed loans, as well as flexible non-qualified mortgages (non-QM loans) for borrowers with unique circumstances. For each and every detail, about their loan servicing you have to read this whole article mentioned below. Features of NewRez MyLoanCare:They provide Manufactured home loans. Get alternative documentation for qualifying purposes. Multiple home loan solutions, including government-backed loans are available. Minimum 580 credit score needed. 3% minimum down payment is required to get a loan. Drawbacks of NewRez MyLoanCare:You can’t see the current rates online. Home equity loans are not available. Loan Products offered by NewR...